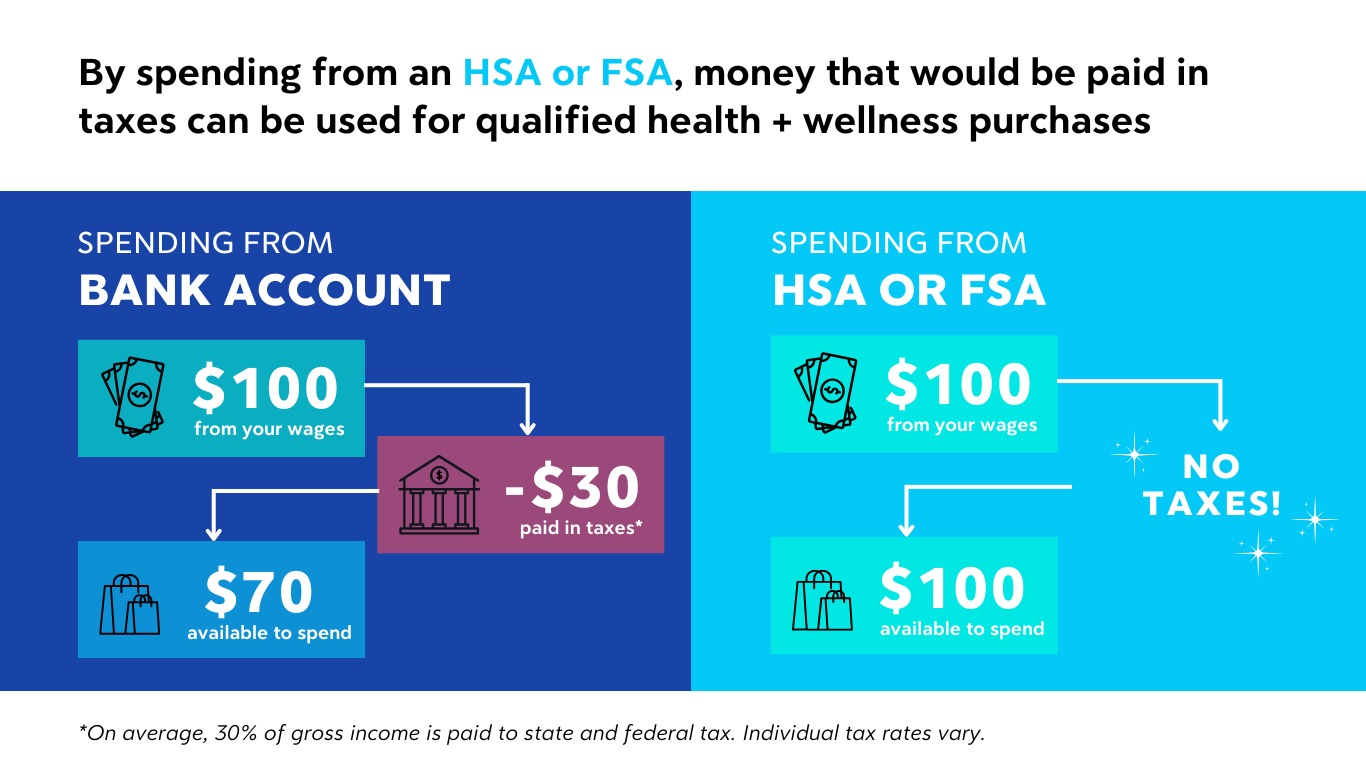

save up to 30% when you qualify to pay with hsa/fsa

ARE YOU ELIGIBLE?

You may be eligible to purchase an Anthros ergonomic chair with a health savings account (HSA), a health reimbursement arrangement (HRA), or a flexible spending account (FSA) using Truemed. The IRS approves using tax-free funds on an ergonomic chair that is needed to mitigate, treat, or prevent a medical condition.

HOW IT WORKS.

1

Configure And Add To Cart

Personalize your Anthros chair and add to cart.

2

Check Out As Guest

Check out as a guest: ensure you are not signed into “Shop Pay”

3

Select Truemed

Select Truemed as your payment option at checkout

4

Purchase With Your HSA/FSA Card

If you pay with your HSA/FSA card, there’s no other work you need to do. Truemed will send paperwork to ensure compliance.

Truemed Provides A Letter Of Medical Necessity

Truemed provides a convenient way for qualifying consumers to get their Letter of Medical Necessity for your products/services, and to pay directly with their HSA/FSA if eligible. By choosing Truemed, you will be asked several questions that will be sent to a qualified medical professional. A letter of medical necessity will then be sent directly to you.

For questions or concerns about your purchase through Truemed, contact support@truemed.com

Registration #3021484401

What is an HSA/HRA/FSA?

HSA

A Health Spending Account (HSA) is a kind of personal savings account that allows you to save pre-tax dollars to use for qualified medical expenses. This account is owned by you, there is no expiration date and non-used funds roll over year after year.

HRA

A health reimbursement arrangement (HRA) is a kind of health spending account provided and owned by an employer. The money in it pays for qualified expenses, like medical, pharmacy, dental, and vision, as determined by the employer.

- Only your employer can put money in an HRA.

- You don't pay taxes on money that comes from an HRA.

- Your employer decides whether to let unused funds roll over from one year to the next.

- Employers have more say in how HAs work and have more options to choose from than other health spending accounts.

FSA

A Flexible Savings Account (FSA) is an account that you put pre-tax dollars into to use for qualified medical expenses. The account is owned by the employer and unused funds at the end of the year are granted to the employer.

NO-RISK PURCHASE PROMISE

*If you pay out of pocket and reimbursement is denied, you can return your chair and Anthros will give your money back; No questions asked.

MORE FAQs

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is.

There are thousands of studies showing food and exercise is often the best medicine to prevent and reverse disease. Exercise qualifies as a qualified medical expense with an LMN. Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need. Your Truemed LMN satisfies all IRS requirements to make your wellness spend fully reimbursable.

Info

Join our email list

Sign up to get special offers, the latest videos, news, + more.